I feel that now is a great time to invest in flying car stocks due to their suppressed valuations amid a sell-off in the broader indices including the S&P 500. Here are three companies who are leading the way in flying car development.

Joby Aviation (JOBY)

Joby Aviation (NASDAQ:JOBY) is showing potential with a recent price jump and better-than-expected earnings, breaking even rather than the anticipated loss. Progress in FAA certification and a significant contract with the U.S. Air Force are positive indicators. The company also has a strong cash position, suggesting a strategy to buy on dips and hold for long-term growth.

The company is advancing its production plans with a new facility in Dayton, Ohio. They aim to produce up to 500 aircraft annually at the site. With these factors considered, JOBY is one of those flying car stocks to buy.

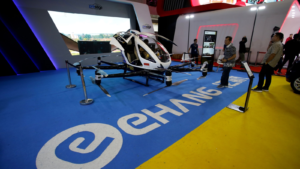

EHang (EH)

EHang (NASDAQ:EH) is a key player in the autonomous aerial vehicle sector, providing innovative urban air mobility solutions. Ehang’s strong market presence and positive technical indicators make it a notable contender in the industry.

Now might be an ideal time to invest in EH stock. The company’s stock rose over 10% recently after receiving a Chinese regulatory certificate for its EH216-S unmanned aerial vehicle. The stage is now set for commercial operations as an aerial taxi with the potential to address China’s vehicle traffic issues.

It also trades at record lows regarding its price-to-earning ratio, which suggests that it could be undervalued. Other financial and liquidity ratios also suggest a strong upside. EH is one of the flying car stocks to keep on your radar.

XPeng (XPEV)

XPeng (NYSE:XPEV) is driving the future of transportation with its modular flying car concept.

The company has made good progress in getting its flying cars off the ground. They have shipped 750 smart EVs to Israel, its largest batch this year. And, XPEV is planning to establish a sales and service network there in 2024. The company also launched the updated 2024 model for their P5 electric vehicle. The new model offers more advanced features and new financing options to buyers.

There’s also good reason to suspect that XPEV is an undervalued flying car stock waiting to be discovered. Recently, the company’s shares entered oversold territory, suggesting potential exhaustion of selling pressure. It is also indicative of a possible entry point for bullish investors.

However, be warned that XPEV is a high-risk, high-reward stock. It is currently facing several challenges including production issues as well as a corruption probe. This has put a question mark over its long-term future. If XPEV can navigate these challenges, investors may find themselves holding some very undervalued shares.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Matthew started writing coverage of the financial markets during the crypto boom of 2017 and was also a team member of several fintech startups. He then started writing about Australian and U.S. equities for various publications. His work has appeared in MarketBeat, FXStreet, Cryptoslate, Seeking Alpha, and the New Scientist magazine, among others.