These companies are pioneering a new age of transportation. Further, the technology is expected to be used in other industries. Those range from warehouses, industrial automation, search and rescue missions, and beyond.

Now is an ideal time to scoop up shares before the indices pull higher. Many of these undervalued flying car stocks come with bullish analyst ratings and expanding top lines. Therefore, they might not stay cheap for long.

So let’s explore three flying car stocks for investors to consider adding to their portfolios this month.

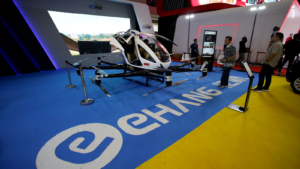

EHang Holdings (EH)

EHang Holdings (NASDAQ:EH) is recognized for its progress in obtaining regulatory approvals. Also, it demonstrates its technology to the pleasure of the investing public.

Last year, EH stock crossed an important milestone. It was issued its type certificate (TC) from the Civil Aviation Administration of China (CAAC) for its EH216-S unmanned aerial vehicle (UAV). This allows its EH216-S vehicle to be used as an aerial taxi. It is the first of its kind to be approved in China.

Other opportunities were realized for the company, too. Last quarter, its revenues surged to $28.62 million, which marked a 247.86% year-over-year (YOY) increase.

Also, its EPS increased during this time, improving from -1.26 in the previous quarter to -1.08. Although the company is currently unprofitable, the EH216-S vehicle has potential. It can solve an important issue with China’s traffic congestion. And, this could be highly accretive for the company moving forward.

Archer Aviation (ACHR)

Archer Aviation (NYSE:ACHR) is well into its FAA testing phase. Additionally, it boasts a strong financial position and a backlog of significant orders.

ACHR has seen its stock price tumble 14.97% year to date (YTD). That may be due to higher interest rates, Chinese market weakness and uncertainties, and some historical February softness.

Still, I’m considerably bullish on ACHR stock for the quality of the technology it uses in its air taxis. This shows a significant leg up on its competitors. This includes its Midnight eVTOLs, which is capable of traveling 100 miles at a speed of 150 mph.

Other facts that make ACHR a bullish pick is the strong institutional backing behind it. That comes from a mix of traditional airlines and investment banks. This includes a $1 billion order from United Airlines (NASDAQ:UAL) and a $150 million investment from Stellantis.

Analysts predict that the company’s stock price could rise 94.33% within the next twelve months.

Joby Aviation (JOBY)

Joby Aviation (NYSE:JOBY) is one of the best undervalued flying car stocks for investors. The company is advancing in its FAA certifications and has partnered for vertiport development in Japan.

Additionally, JOBY is making clear progress toward commercialization and profitability. In fact, it’s been actively working towards its expected 2025 launch. This will position JOBY with a clear edge over its peers due to its early time in the market.

Other milestones that the company has accomplished recently could keep investors feeling bullish. Notably, JOBY achieved a significant milestone by becoming the first electric air taxi to be delivered to the U.S. Air Force.

Therefore, Wall Street rates JOBY with a 50.35% potential increase in its stock price over the next twelve months.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Matthew started writing coverage of the financial markets during the crypto boom of 2017 and was also a team member of several fintech startups. He then started writing about Australian and U.S. equities for various publications. His work has appeared in MarketBeat, FXStreet, Cryptoslate, Seeking Alpha, and the New Scientist magazine, among others.