The stocks discussed in this article represent what I believe to be the best strong buy flying car stocks on the market today. Investors should look at each one for its fundamentals and prospects for growth.

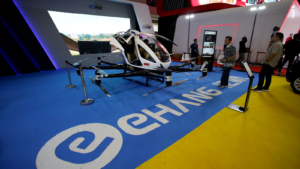

EHang (EH)

EHang (NASDAQ:EH) received the world’s first type certification (TC) for unmanned electric vertical takeoff and landing (eVTOL) aircraft from the Civil Aviation Administration of China. A TC indicates the aircraft complies with the agency’s safety standards and airworthiness requirements. EHang also boasts an impressive order backlog.

There have been some recent developments that I think significantly bolster the bull case for EH stock. Namely, it revealed a suggested retail price of $410,000 for its EH216-S pilotless, passenger-carrying eVTOL aircraft for global markets outside China beginning April 1. The new, elevated pricing model shows rising global demand for flying cars.

Meanwhile, the company’s order pipeline for the EH216-S in China has reached over 100 units. It expects to fulfill those orders within one to three years. EHang maintains the aircraft is perfect for air taxi services, aerial tourism, airport shuttles and cross-island transportation.

Only one Wall Street analyst covers EH stock but he expects its revenue to increase 268% next year to $62.22 million. Earnings per share (EPS) are forecast to reach breakeven territory sometime between FY2024 and FY2025.

Joby Aviation (JOBY)

Joby Aviation (NYSE:JOBY) is one of the most talked about strong buy flying car stocks in the financial media. Due to the overwhelmingly positive consensus that has formed around the stock, its performance is sometimes equated to that of the entire flying car industry .

Joby is establishing itself as the leader in the U.S. eVTOL market. Its efforts in obtaining necessary certifications from the Federal Aviation Administration (FAA) are pivotal to moving beyond the pre-revenue stage.

Things seem to be proceeding well for JOBY stock. It’s installing a network of air taxi chargers while developing vertiports in collaboration with industry partners. This is part of eVTOL company’s broader strategy to create a robust network to support its fleet of flying cars. That’s not much different from the progress we’ve seen by Tesla (NASDAQ:TSLA) in rolling out its Supercharger network.

Analysts expect Joby revenue to surge 1,983% in FY2024 while achieving breakeven status sometime after FY2029. This EPS projection is assumed since that figure could reach eight cents in FY2028.

At present, I believe that Joby Aviation provides investors with the best potential for dramatically scaling revenue and a clear runway to reach profitability. That makes it one of the best strong buy flying car stocks to consider.

Archer Aviation (ACHR)

Archer Aviation (NYSE:ACHR) is what I consider to be a slightly underestimated option in the flying car industry. It’s charging headfirst into getting FAA certification for its Midnight eVTOL aircraft in a bid to launch air taxi services by 2025. That would put it amongst the industry’s early movers. Archer plans on building six Midnight aircraft this year.

At the same time, the aircraft manufacturer will also focus on its Space Act Agreement with NASA to collaborate on mission-critical eVTOL aircraft technologies. NASA will test Archer’s high-performance battery cell and system design for the Midnight craft. Batteries are seen as a key technology for mass production and adoption of flying cars.

Soon, producing those Midnight aircraft will come from what Archer calls the “world’s highest-volume eVTOL aircraft manufacturing facility” in Covington, Georgia. It received $65 million in financing to help construct the facility late last year. The plant can produce as many as 650 aircraft per year, which could go higher as production capacity scales up.

Wall Street appreciates ACHR stock’s efforts. It has a “strong buy” rating with an implied one-year upside of 95% for its stock price.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Matthew started writing coverage of the financial markets during the crypto boom of 2017 and was also a team member of several fintech startups. He then started writing about Australian and U.S. equities for various publications. His work has appeared in MarketBeat, FXStreet, Cryptoslate, Seeking Alpha, and the New Scientist magazine, among others.