Inflation is making a comeback.

And stocks are crashing in response.

Time to dump stocks and head for the hills?

Hardly. On the contrary, thanks to investors’ knee-jerk reaction, this is a golden buying opportunity.

That’s because this little inflation “setback” is just a temporary blip. We’re confident it will end next month. And when it does, stocks should really blast off.

This is the time to buy the dip.

Why Inflation Will Keep Falling Again Soon

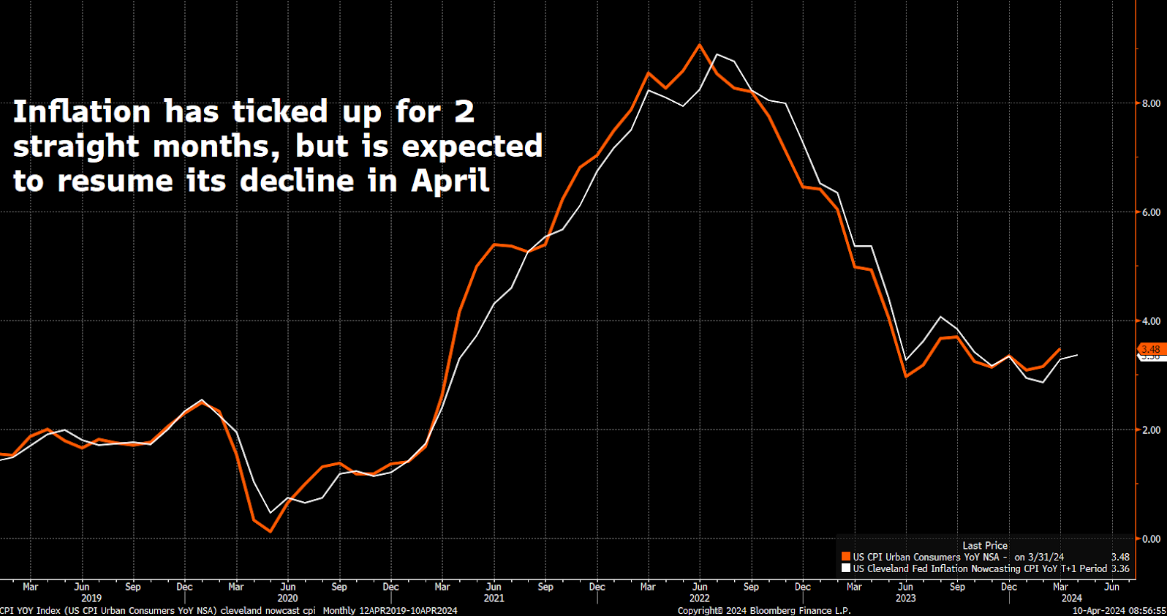

Throughout the second half of 2022 and nearly all of 2023, the U.S. inflation rate slid from 9% to 3% pretty consistently.

That trend has changed course in 2024. In January, CPI clocked in at 3.1%. It rose to 3.2% in February, then 3.5% in March.

This sudden “reinflation” is spooking investors. Some pundits are calling for inflation to heat back up to 5%-plus in the coming months.

But we’re confident that’s not going to happen.

Instead, we expect March to be the last month of “reinflation.” Starting this month, inflation will likely start falling again.

The reinflation we’ve seen over the past two months has been driven mostly by the Fed’s dovish December pivot in policy, when it forecasted three rate cuts in 2024. That sent yields crashing, which supported more economic demand across the country through more spending, more investment, etc.

Now the Federal Reserve is walking back those rate-cut projections. And after today’s report, it’ll likely embrace a fully hawkish stance. Yields have already surged over the past few weeks and could continue to. This dynamic will choke off economic demand across the country through less spending, less investment, etc.

And that will, of course, lead to lower inflation rates.

The Likely Inflation Trajectory

Indeed, the Cleveland Fed’s Nowcasting model calls for inflation to drop to 3.4% in April from 3.5% in March, which will end the recent streak of reinflation.

What does that mean for stocks?

They’ll start rising again very soon.

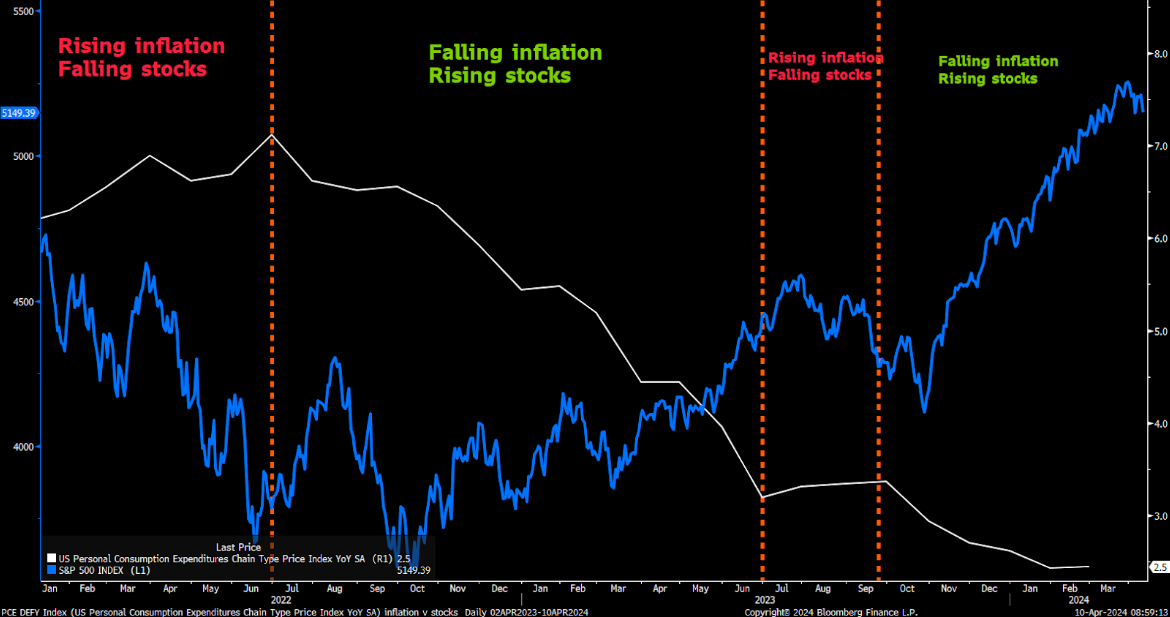

For the past two years, stocks and inflation have been nearly perfectly inversely correlated. When inflation rises, stocks fall. When it falls, stocks rise. Just consider:

Throughout the first half of 2022, inflation roared higher while stocks crashed. From summer 2022 to summer 2023, inflation crashed while stocks roared higher. In the fall of 2023, inflation pushed higher while stocks dropped. And in the winter of 2023, inflation started falling again while stocks rallied.

Now here in early 2024, stocks are struggling as inflation reheats. No surprise there.

So, with inflation set to resume its decline shortly, it should come as no surprise that stocks will resume their rally, too.

This isn’t time to run for the hills. It’s time to buy the dip.

And we have the perfect set of stocks to take advantage of this buying opportunity.

The Final Word

The AI Race is heating up. Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Apple (AAPL) are all investing billions of dollars to create the best AI programs in the world.

But we think the “dark horse” in this race is Elon Musk’s new AI startup, xAI. It’s currently in talks to raise $3 billion at an $18 billion valuation – and the company was founded just a year ago.

From zero to $18 billion… in just a year – it appears something special is happening over at xAI.

And for a variety of reasons, we think xAI could emerge as one of the leaders in the AI Race.

Though of course, xAI isn’t public. It’s a private startup. But for investors interested in betting on the firm’s enormous growth potential over the next few years, we’ve found the perfect stock to play it.

Our research suggests this company could very well be xAI’s top AI components supplier.

Learn its name and ticker symbol now.