In fact, Wall Street has been holding its breath since that data’s release, eagerly awaiting the Fed’s next update. And today, investors can finally breathe again.

We believe the Federal Reserve may have just saved the U.S. economy from a recession – and given investors the green light for a huge summer rally.

The Highly Anticipated Fed Update

Over the past two days, members of the central bank met to discuss monetary policy.

Today, the Fed announced the results of that meeting and decided to leave interest rates unchanged. No surprise there.

But things started to get interesting in the post-meeting press conference, when Fed Board Chair Jerome Powell took the stage to discuss the central bank’s outlook for monetary policy.

See; back in December, Powell stated that the Fed was done hiking interest rates and, instead, would likely cut rates in 2024. The market got excited about the prospects for rate cuts, and stocks rallied.

Yet over the past two months, inflation has proven more stubborn than anticipated. Inflation data has consistently come in above expectations, causing investors to assume the Fed would pivot hawkish and hint that another rate hike could be looming.

But that didn’t happen.

Instead, during today’s press conference, Powell largely doubled-down on his December outlook. He kept saying that monetary policy is currently sufficiently restrictive to get inflation back to 2%. He said that we likely don’t need another rate hike and that cuts are still likely on the way.

In other words, Powell confirmed the bull thesis on stocks.

The Final Word

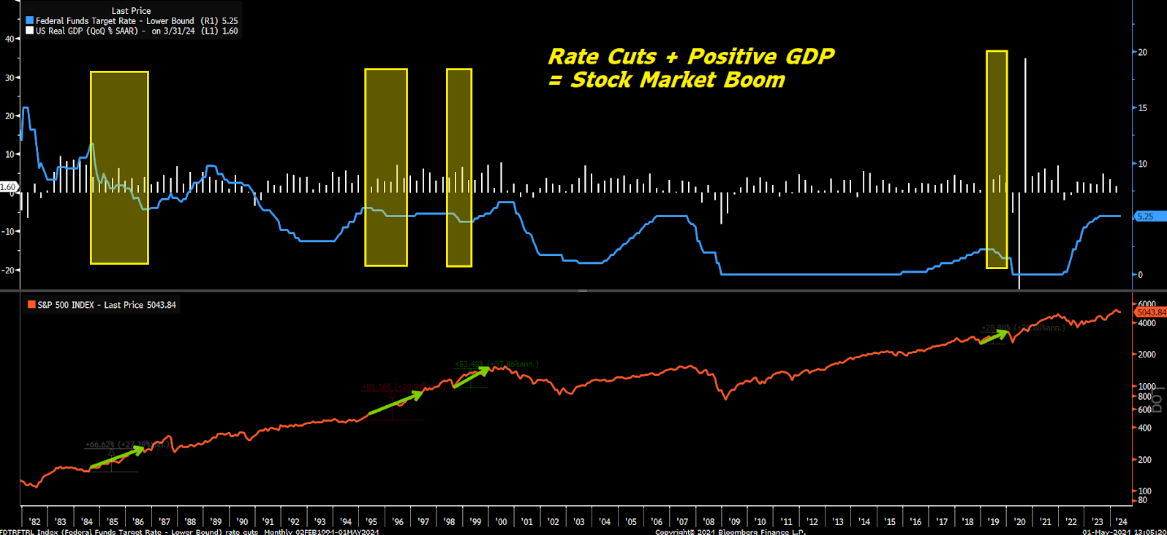

Just consider; for the past 40 years, whenever the Fed has cut rates while the economy has continued to expand, stocks have rallied every single time.

It’s quite a rare combination of factors. And it always means great things for stocks.

This happened in the mid-1980s. The Fed cut rates while the economy kept growing. During that time, the market jumped about 65%.

It happened again in the mid-1990s, when the Federal Reserve cut three times while the economy continued to expand. And that led the S&P 500 to rally 90%.

Then in the late €˜90s, the Fed cut rates twice while the economy kept flourishing, leading to a 50% market rally.

And most recently, this phenomenon happened in the late 2010s – and powered a 30% rally in stocks.

The historical precedent is clear. Whenever the Fed cuts rates while the economy continues to grow, stocks rally.

That’s about to happen all over again. And the Fed confirmed as much today.

That means now is the time to buy stocks – before the epic summer rally.

Find out which stocks are our favorites to buy right now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.