However, we need to consider the reality of quantum computing: it has no wide-scale reach or practical applications now. It’s a budding technology, and scale will be achieved once companies have the technology down for mass production.

Still, quantum computing stocks are at the forefront of the technology, allowing investors to buy in before things escalate. As such, I’ve screened the market and compiled a list of three promising quantum computing stocks that could lead the next technological step.

To come up with this list, I used the following criteria:

- Companies involved in the development of quantum computing technology,

- Positive revenue growth and,

- Buy ratings from analysts.

I then sorted the list based on revenue growth from highest to lowest, using these criteria to focus only on promising quantum computing stocks with positive revenues.

IonQ (IONQ)

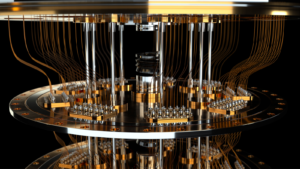

IonQ (NYSE:IONQ) is a quantum computing company that delivers high-performance systems for solving research and commercial use cases. The company’s IonQ Forte quantum computer offers 36 algorithmic qubits, representing its highest-performing and largest single-core quantum processor. IonQ is currently collaborating with Oak Ridge National Laboratory to drive improvements to modernize the U.S. power grid infrastructure.

IonQ ended FY’23 with a significant technical milestone, reaching #AQ 35 in December 2023, a year earlier than anticipated, and #AQ 36 a month later. #AQ, or Algorithmic Qubits, is IonQ’s proprietary benchmark to measure a quantum computer’s ability to solve real-world user concerns, making it a good measure for practical applications.

In addition, the company improved the implementation of photonic interconnects for networked QPUs, potentially improving the future of quantum computing capabilities.

Regarding financials, IonQ grew its annual revenue by 98% year over year and increased annual bookings by 166%. Despite a net loss in earnings, analysts rate IONQ stock a “Buy,” likely because of its future prospects in quantum computing companies.

Sealsq (LAES)

Sealsq (NASDAQ:LAES) specializes in developing and selling quantum-resistant secure microcontrollers. It’s a Swiss holding company that operates in the semiconductor industry and develops tamper-resistant semiconductors, firmware, processors and Post-Quantum technology products. The company previously announced the establishment of its subsidiary SEALSQ USA, which is part of its plan to create an Open Semiconductor Assembly and Test Center in the U.S. by 2025.

The company is also developing its WISeSat picosatellite constellation project to bolster satellite IoT device connectivity, especially in low-connectivity regions, capitalizing on its semiconductor expertise.

Sealsq reported strong revenue growth in FY’23, reaching $30.1 million, a 30% YOY increase compared to its $23.2 million in FY’22. The company spent 22% in R&D this year in developing its post-quantum chip. No wonder it has a strong buy rating as a recommendation. If you are looking for promising stocks at a different quantum angle, then LAES stock is right.

Amazon (AMZN)

We all know the humble beginnings of Amazon (NASDAQ:AMZN) as a little e-commerce website that grew into a behemoth in today’s tech industry. The company’s passion for growth led it to take a big step forward in the fight for quantum computing in 2019 on the grounds of Caltech, a recognized university specializing in science and engineering.

Amazon Web Services, the company’s proprietary cloud platform, offers vendors and various suppliers like IonQ and Oxford Quantum the right to purchase fully-managed quantum computing gear from Amazon Braket. This lets its clients experiment with different hardware designs that suit their requirements. With its large research and development spending, Amazon has even built an in-house chip that is custom-designed and claims to have an error suppression rate of a factor of 100.

In contrast, some may think that Amazon.com may be late to the quantum show; its financial resources and continuously growing revenues, which ended at 12% higher YOY for FY’23, are a big factor that it can still play the long game. Analysts rate AMZN stock as a strong buy and consider it a growth stock, even with its size.

On the date of publication, Rick Orford held long positions in AMZN. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Rick Orford is a Wall Street Journal best-selling author, investor, influencer, and mentor. His work has appeared in the most authoritative publications, including Good Morning America, Washington Post, Yahoo Finance, MSN, Business Insider, NBC, FOX, CBS, and ABC News.