Below are 3 robotics stocks to buy in May 2024.

Stryker Corportation (SYK)

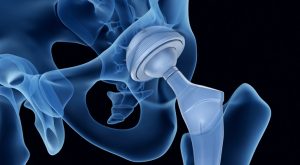

The first entry on this list is Stryker Corporation (NYSE:SYK), which operates primarily as medical technology (“MedTech”) firm in the United States. Stryker has two main business segments, “MedSurge and Neurotechnology,” on the one hand, and “Orthopedics and Spine,” on the other. While the latter focuses on the construction of implants for joint replacement procedures, the “MedSurge and Neurotechnology” segment specializes in designing and selling a variety of medical and surgical equipment. These include everything from bedframes to infrastructure and room design for hospitals. In addition, Stryker offers a product called “Mako,” which is a robotic arm that assists surgeons performing joint replacement surgeries.

The MedTech firm has been able to drive organic growth in recent quarters. For Stryker’s fourth quarter earnings report for fiscal year 2023, organic sales growth came in at more than 11% on a year-over-year basis. Stryker was able to deliver similar robust growth figures in their first quarter earnings report for fiscal year 2024.

Strong financial figures coupled with SYK trading at around 26.8x forward earnings, make MedTech stock look like an intriguing investment.

Intuitive Surgical (ISRG)

Intuitive Surgical (NASDAQ:ISRG) has made a number of my robotics lists in the past. Solid share-price performance and robust product growth keeps me coming back. For those unaware, Intuitive Surgical develops and manufacturers robotics products for surgical procedures. The medical robotics firm’s flagship product includes the da Vinci Surgical System that comes with advanced instrumentation and vision capabilities.

In 2023, installed da Vinci systems performed well over 2.2 million surgical procedures. Since its inception, surgeons have successfully leveraged the da Vinci product in over 14.8 million procedures. Moreover, Intuitive Surgical continued to see strong production traction in the first quarter of 2024. da Vinci procedures increased 16% on a year-over-year basis, while total installations grew 14% from 7,779 in Q1’2023 to 8,887 in Q1’2024.

ISRG has seen its share price increase 18.6% a YTD-basis as of the end of Monday’s trading session.

Symbotic (SYM)

Symbotic (NASDAQ:SYM) makes the final entry on this list. The supply chain and logistics sectors the economy have required higher levels of automation since the COVID-19 pandemic precipitated a number of supply chain bottlenecks. Runaway inflation has also spurred investment in products that drive efficiencies. This is where Symbotic comes in.

The “Symbotic System” involves a complex array of autonomous robots for warehouses and AI-powered technology that help traditional warehouses manage assets and move goods from one place to another. Symbotic has enjoyed strong sales growth since 2021. In fact, fiscal years 2021 and 2022 saw revenue increase by 174% and 136%, respectively. In 2023, Symbotic was able to nearly double sales from $593.3 million in 2022 to $1.2 billion.

Most recently, for the period covering the first three months of 2024, revenue jumped 59% YoY to $424.3 million, while the company’s net loss compressed to $13.6 million.

With such robust growth figures, SYM deserves a look at any investor interested in the robotics space.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Tyrik Torres has been studying and participating in financial markets since he was in college, and he has particular passion for helping people understand complex systems. His areas of expertise are semiconductor and enterprise software equities. He has work experience in both investing (public and private markets) and investment banking.