U.S. equities markets have surged with the rise of generative artificial intelligence (AI) and its potential to create enormous efficiencies and profits for firms across various industries. While AI has brought quantum computing back into the spotlight, a lack of practical ways to scale these complex products has severely dented the performance of pure-play quantum computing stocks, such as IonQ (NYSE:IONQ) and Rigetti Computing (NASDAQ:RGTI).

Fortunately, not every public company invested in quantum computing has seen doom and gloom. Below are the three best quantum computing stocks investors should buy in June.

International Business Machines (IBM)

International Business Machines (NYSE:IBM) is a legacy American technology business. It has its hands in everything from cloud infrastructure, artificial intelligence, and technology consulting services to quantum computers.

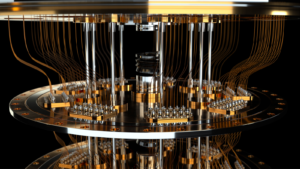

The firm committed to developing quantum computing technologies in the early 2000s and tends to publish new findings in the burgeoning field frequently. In December 2023, IBM released a new quantum chip system, Quantum System Two, that leverages the firm’s Heron processor, which has 133 qubits. Qubits are analogous to bytes on a classical computer. But instead of being confined to states of 0s and 1s, qubits, by way of superposition, can assume both states at the same time.

Moreover, what makes Quantum System Two particularly innovative is its use of both quantum and classical computing technologies. In a press release, IBM states, “It combines scalable cryogenic infrastructure and classical runtime servers with modular qubit control electronics.” IBM believes the combination of quantum computation and communication with “classical computing resources” can create a scalable quantum machine.

IBM’s innovations in quantum computing technologies as well as AI has not gone unnoticed either. Shares have risen 31.3% over the past 12 months. The computing giant’s relatively cheap valuation coupled with its exposure to novel, high-growth fields could boost the value of its shares in the long-term.

Nvidia (NVDA)

Investors have given Nvidia (NASDAQ:NVDA) attention and praise over the past 12 months due to its critical role in AI computing technologies. The chipmaker’s advanced GPUs, including the H100 and H200 processors, are some of the most coveted chips on the market. The new Blackwell chips, coming to the market in the second half of 2024, bring to the table even better performance.

Though Nvidia’s prowess in the world of AI captures much of the headlines, the firm has already made inroads into the next stage of computing. In 2023, Nvidia announced a new quantum system in conjunction with startup Quantum Machines. It leverages what Nvidia calls the Grace Hoper Super Chip (GH200) as well as the chipmaker advanced CUDA Quantum (CUDA-Q) developer software.

In 2024, Nvidia released its Quantum Cloud platform, which allows users to build and test quantum computing algorithms in the cloud. The chipmaker’s GPUs and its open-source CUDA platform will likely be essential to scaling up the quantum computing space.

Nvidia’s share price has surged 214.2% over the past 12 months.

FormFactor (FORM)

Quantum computers are complex machines that require all kinds of components. Furthermore, it is vital for quantum systems to operate at extremely low temperatures in order to operate efficiently.

FormFactor (NASDAQ:FORM) specializes in developing cryogenic systems – or systems that are meant to deal with low temperatures. Everything from wafer testing probes to low-vibration probe stations as well as sophisticated refrigerators call cryostats, FormFactor provides. Also, the firm’s analytical probe tools are useful for developing advanced chips, such as NAND flash memory.

With quantum computing systems and advanced memory chips in greater demand these days, FormFactor could see revenues and earnings rise in the near and medium terms. FormFactor’s share price has surged 77.5% over the past 12 months, underscoring that investors are taking notice of the company’s long-term value.

At the beginning of May, FormFactor released first quarter results for fiscal year 2024 and topped revenue estimates while EPS came in line with market expectations. The firm expects strong demand for advanced memory chips, such as DRAM, will help propel revenue growth in the following quarters.

On the date of publication, Tyrik Torres did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Tyrik Torres has been studying and participating in financial markets since he was in college, and he has particular passion for helping people understand complex systems. His areas of expertise are semiconductor and enterprise software equities. He has work experience in both investing (public and private markets) and investment banking.