While the technological and regulatory hurdles are still significant, successful flying car stocks to buy could mint billions for early investors who get in on the ground floor. This is due to their low valuations and small market caps. These could make this a prime investment vehicle for those who have a high risk tolerance.

The following stocks are great if you are in the market for some adventurous growth investments in an emerging industry. Here are three flying car stocks to buy before they lift off to nTew heights. Don’t miss out on these companies or you may end up regretting it later.

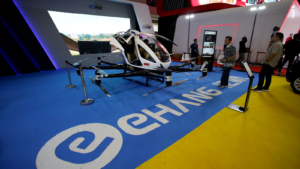

EHang Holdings (EH)

EHang Holdings (NASDAQ:EH) specializes in unmanned eVTOLs with a significant presence in China.

Notable developments for EH include its partnership with DHL-Sinotrans. The two will explore the EH216 flying car for delivery services. There is also a Memorandum of Understanding with the Bao’an District Government in China. This memorandum will support the assembly and delivery of EH216-S autonomous aerial vehicles. Additionally, EH delivered 13 aircraft in Q3 last year.

The financial forecast for EH is optimistic, with projections indicating a potential average stock price of $72.87 by 2025. This would represent a significant increase from its current valuation, which is just around $17 at the time of writing.

In the near-term, investors could have something to look forward to. Specifically, the brand’s revenue is expected to surge 88.64% to 117.38 million. There are also projected EPS improvements on the horizon as well.

EH stock could be one of those flying car stocks to buy for investors interested in the industry as well as wanting to diversify their portfolio with an emerging market pick.

Archer Aviation (ACHR)

Archer Aviation (NYSE:ACHR) is a leader in the eVTOL industry, targeting commercial operations by 2025 with FAA certification expected by the end of 2024.

The company has an indicative order book valued at up to $3.5 billion, with a volume manufacturing facility anticipated to be completed within the year, enabling the production of up to 650 aircraft annually starting in 2025. ACHR’s flight test program is on schedule for 400 flights in 2024.

With the FAA issuing ACHR’s Midnight aircraft a Special Airworthiness Certificate, ACHR is positioned to commence flight test operations, moving closer to its 2025 commercial launch goal €‹ Furthermore, despite a reported net loss of $457.9 million for FY 2023, ACHR ended the year with around $625 million in cash and cash equivalents.

ACHR is one of the best flying car stocks to buy, as it’s one of the few that has management to balance its high debt load with high revenue visibility into the near future.

Eve Holding (EVEX)

Eve Holding (NYSE:EVEX), is differentiated by its backing from Embraer and partnership with United Airlines (NASDAQ:UAL) for 200 air taxis. The brand is In the pre-revenue stage, and is aiming for commercialization in the near future.

The company has plans to begin testing its first full-scale prototype in the latter part of 2024. It also announced its first production facility in Brazil in mid-2023 and has entered the Joint-Definition Phase (JDP) of its development program.

The company has non-binding Letters of Intent (LOIs) for 2,850 aircraft from 29 different customers across 13 countries and is also developing Urban Air Traffic Management (Urban ATM) software. With over $300 million in liquidity, EVE believes it has sufficient funding through 2025 €‹ €‹.

According to MarketBeat, analysts have given EVE a consensus rating of “Hold” with a price target range of $7 to $10, suggesting a possible upside of 61.9% from the stock’s current price. This then makes it one of those flying car stocks to buy.

On the date of publication, Matthew Farley did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Matthew started writing coverage of the financial markets during the crypto boom of 2017 and was also a team member of several fintech startups. He then started writing about Australian and U.S. equities for various publications. His work has appeared in MarketBeat, FXStreet, Cryptoslate, Seeking Alpha, and the New Scientist magazine, among others.