I think that could change once OpenAI releases its Sora text-to-video AI system. The company has released many preview videos along with certain prompts, and by all accounts, there’s a lot here. I believe this technology could be revolutionary for content creators. People spend a good chunk of their free time watching videos on various platforms. Once Sora becomes available to the public, I think it could see a lot of usage.

Here are three stocks you might want to look into to ride this growth wave higher.

Microsoft (MSFT)

Microsoft (NASDAQ:MSFT) is a technology giant providing cloud computing and productivity software. I believe Microsoft is uniquely-positioned to be the primary beneficiary of OpenAI’s Sora and the broader AI revolution. The company’s early investments in OpenAI have not only kickstarted the current AI rally, but also gave Microsoft significant leverage over OpenAI’s profits. Reports suggest Microsoft will receive 75% of OpenAI’s profits until it recoups its investment, followed by a 49% share until it earns $92 billion in profit.

Regardless, the partnership has already paid dividends, with over 65% of Fortune 500 companies now using Azure OpenAI Service. The number of $100 million-plus Azure deals increased over 80% year-over-year, while $10 million-plus deals more than doubled.

Copilot for Microsoft 365 is already seeing accelerated adoption, with nearly 60% of Fortune 500 companies now using it. The white-collar industry can’t live without Microsoft, and the company has been a growth compounder for years. Recently, it appears these trends have only been accelerating. I think MSFT stock is one of the best long-term bets you can make, independent of how OpenAI’s Sora AI plays out.

Adobe (ADBE)

Adobe (NASDAQ:ADBE) makes software for digital content producers. The company’s strong Q2 2024 results highlight the growing appeal of its AI-powered creative tools. Revenue grew 11% year-over-year to $5.31 billion, beating estimates, while non-GAAP earnings per share of $4.48 also exceeded expectations.

I believe Adobe is well-positioned to benefit from the AI mega trend, especially with the impending launch of OpenAI’s Sora text-to-video model. The company has already successfully integrated generative AI into flagship products like Photoshop, Illustrator, and Lightroom. Since debuting in March 2023, Adobe’s Firefly AI has generated over 9 billion images across its creative apps.

However, I think Sora could take Adobe’s offerings to a whole new level, especially in the video editing space, where Adobe is already very popular.

While Adobe’s stock is still down 19.5% from its peak, it has rebounded 10.4% over the past month. Given the strong Q2 results and AI tailwinds, I believe this presents an attractive opportunity to buy the dip.

Western Digital (WDC)

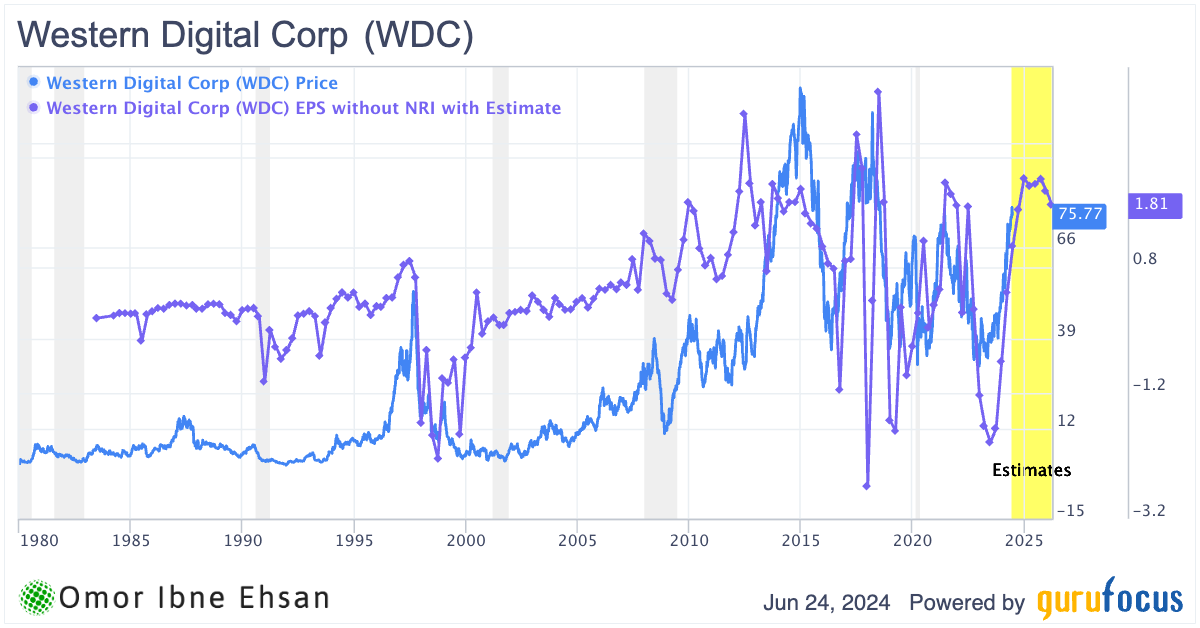

Western Digital (NASDAQ:WDC) designs and manufactures data storage devices and solutions. WDC stock has soared over 100% over the past year alone. I believe this momentum could accelerate further as the AI and data boom kicks into high gear.

In Q3 2024, Western Digital delivered impressive results, with earnings per share of 63 cents beating estimates by 42 cents. Revenue also came in at $3.46 billion, growing a robust 23.33% year-over-year. Management highlighted the company’s surging demand in its core data center segment as a key driver of this growth. As more companies develop their own AI models, including advanced text-to-video systems, the need for Western Digital’s storage solutions should only intensify.

If text-based AI alone can fuel such a data boom, I can only imagine the storage demand that Sora’s crisp, AI-generated videos might unleash. Western Digital seems perfectly-positioned to ride this coming tsunami of data growth. With its stock already having doubled, I wouldn’t be surprised to see WDC stock continuing to climb higher. However, investors may still want to be somewhat cautious with this name, since we could still be near a cyclical high.

Click to Enlarge

On the date of publication, Omor Ibne Ehsan did not hold (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Omor Ibne Ehsan is a writer at InvestorPlace. He is a self-taught investor with a focus on growth and cyclical stocks that have strong fundamentals, value, and long-term potential. He also has an interest in high-risk, high-reward investments such as cryptocurrencies and penny stocks. You can follow him on LinkedIn.