But the evidence suggests that this is a time to be greedy when others are fearful…

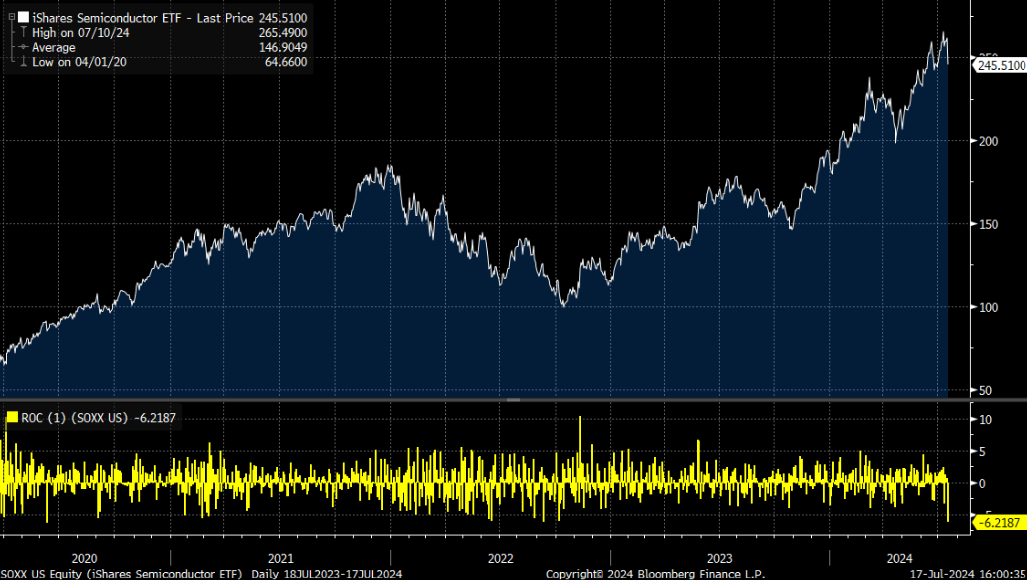

Broadly speaking, yesterday was the worst day for AI chip stocks since the height of the COVID-19 pandemic. The iShares Semiconductor ETF (SOXX) dropped more than 7%, matching its worst single-day drop since the depths of the COVID crash.

The culprit behind this decline – geopolitics.

Why AI Chip Stocks Plummeted This Week

Yesterday, reports leaked suggesting that the Biden administration is looking to impose even stricter controls on sales of semiconductors and related equipment to China. Meanwhile, former President Donald Trump sounded negative in his comments about Taiwan (the semiconductor manufacturing capital of the world).

Investors’ net takeaway was that no matter who wins the White House in November, there will likely be increased scrutiny on the exchange of AI products and equipment between the U.S. and Asia.

But this scrutiny is nothing new. Ever since 2016, when Trump was first elected, the U.S. has been engaged in an on-again, off-again trade war with China. But it seems this trade war – under both Trump and Biden – has been 95% talk and 5% action. And the little action imposed has not materially impacted the revenues, profits or stock prices of chipmakers.

After all, even after yesterday’s drop, the SOXX ETF is still up almost 50% over the past year.

That’s why we think the market is grossly overreacting to a bunch of political “hot air” that will amount to a nothing-burger for AI chipmakers.

Much more importantly, we expect these chipmakers to report strong quarterly earnings over the next few months on the back of continued AI momentum, the likes of which reaffirms their fundamental strength.

And with that validation, AI chip stocks should bounce back strongly.

The Final Word on the Bull Thesis for AI Chip Stocks

The technicals support the bull thesis here, too.

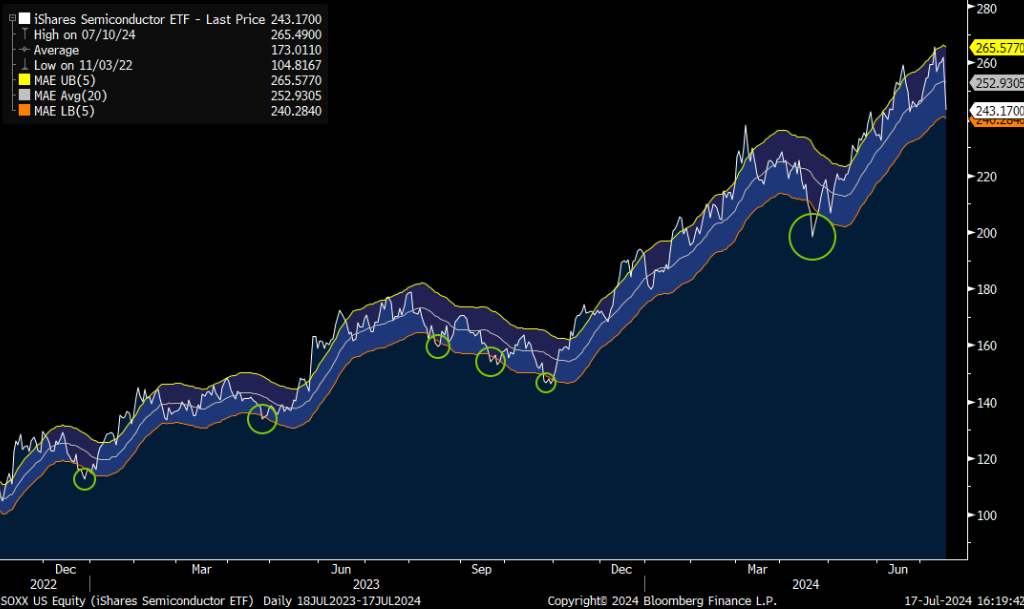

The SOXX ETF is on the cusp of dropping outside the lower band of its 20-day Moving Average Envelope. Essentially, that means the ETF is about to fall 5% below its 20-day moving average.

Ever since ChatGPT’s launch in November 2022, similar drops below the lower band of SOXX’s 20-day Moving Average Envelope have led to strong short-term rebound rallies.

Therefore, we are directionally bullish on a rebound in AI chip stocks after yesterday’s bloodbath.

Does that mean the time to buy is right now? Not necessarily.

We’re urging caution until strong technical support arrives. But… once that happens… we would be aggressive buyers on a rebound in the best AI chip stocks.

Which stocks are we talking about?

Learn about a few of our favorites right now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.