That isn’t always the case.

Just consider: Arm Holdings (ARM).

The AI chip designer reported quarterly earnings last night. And ARM stock dropped in response. Obviously, that’s because the firm released bad numbers, right?

Wrong.

ARM: Stellar Earnings Still Preempt a Slide

Across the board, Arm beat estimates – on revenues, gross profits, operating profits, and earnings per share.

Revenues rose a very robust 47% in the quarter. Gross margins clocked in at an impressive 95%. Operating margins expanded healthily to 42%. Operating profits hit a record high. And management expects more of the same this coming year – over 20% revenue and profit growth.

Indeed, Arm reported fabulous earnings. The stock only dropped because investors had lofty expectations going into the report. And the firm’s great numbers still couldn’t live up to those lofty expectations.

But let’s focus on the forest through the trees here.

Regardless of the one-day stock price reaction, Arm is growing revenues at a nearly 50% clip. And what’s driving all that growth? The AI Boom.

Companies are increasingly looking to build new AI applications, products, and services. And that first requires building AI chips to run those applications, products, and services.

As a result, companies are spending boatloads of cash building those chips. And Arm is winning in that process.

The big takeaway for us? The AI Boom is firing on all cylinders.

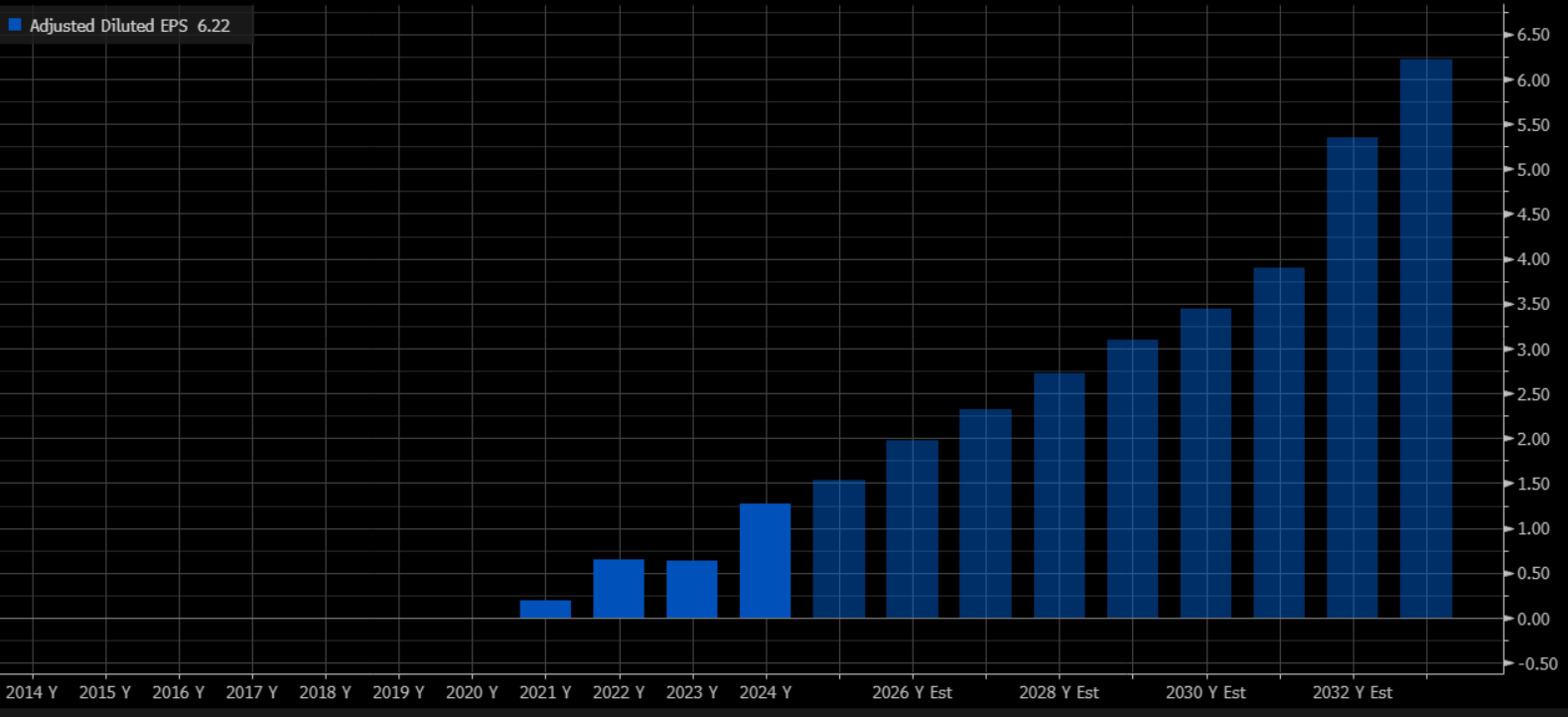

That’s why Arm is expected to grow revenues by nearly four-fold – and earnings per share by nearly five-fold – over the next 10 years.

So, don’t let the headlines or short-term price action spook you out of a great long-term AI investment like ARM. We think the stock will be above $200 within a few short years.

Though, as this earnings season made clear, it’s certainly not the only AI stock with explosive potential…

The Final Word

To us, this earnings season has unequivocally proven that the AI Boom is the “real deal.”

Everyone from Microsoft (MSFT) to Alphabet (GOOGL) to Meta (META) is spending an incredible amount of money to build out next-gen AI offerings.

In time, this new generation of AI applications, products, and services will become ubiquitous – and we’ll be living in a world dominated by AI.

Between now and then, the best AI stocks will absolutely soar – just like the best internet stocks did in the 2010s.

Indeed, as Amazon‘s (AMZN) internet-powered shopping app took over the retail industry in the 2010s, AMZN stock soared nearly 1,300%. Similarly, as Netflix‘s (NFLX) internet-powered streaming app took over the entertainment industry in the 2010s, NFLX stock rocketed more than 4,000%.

Now with the AI Boom of the 2020s at our door, we think investors have a second chance at creating that type of wealth.

You just have to know what AI stocks to buy this time around.

For that, we turn to the next wave of the AI Boom – robotics.

The AI Boom’s first wave was all about AI software like ChatGPT. And now it seems that wave has come and gone. The next one is approaching, and it’s all about integrating AI software into robots to automate tasks.

This probably sounds like mere science fiction, I know. But everyone from Elon Musk to Jeff Bezos to OpenAI’s Sam Altman is investing in robotics these days.

This is where the smart money is shifting right now. So, if you want to stay ahead of the game, it’s time to shift with them.

Learn all about our favorite AI robotics stocks to buy right now for enormous returns.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.