A few climate change stocks appear prepared to deliver strong returns for sustainability-focused investors in sectors aligned with lower carbon solutions:

NextEra Energy (NEE)

U.S.-based global leader in utility-scale wind and solar energy production, NextEra Energy (NYSE:NEE), is a must candidate as one of the climate change stocks to invest in. As one of the largest utilities, it has economies of scale and competitive advantages to generate strong returns as it works to be the foremost provider of clean energy. The company has a decent track record of delivering value to shareholders, having raised earnings at an average annual rate of 9% over the last decade. The company consistently raised its dividend for many years, including the pandemic.

NextEra has solid profitability metrics, unlike other future-oriented climate change stocks. It trades at a price-to-earnings (P/E) ratio of 18x while offering a forward dividend yield of 3.1%. Despite falling net income growth (NIG) of 10% in the last quarter, it represents only a marginal drop compared to 93.53% growth in 2023. In addition to consistently beating analysts’ EPS estimates over the past few quarters, net operating cash flow soared 54.50% on sales.

ChargePoint (CHPT)

As the operator of the largest network of electric vehicle (EV) chargers worldwide, ChargePoint (NYSE:CHPT) is yet another pick in this list of climate change stocks. The company commands approximately a 70% market share of fast chargers. In addition to operating the most extensive EV charging network, it manufactures charging hardware and software solutions other companies utilize to establish charging sites. This allows ChargePoint to penetrate the market further as the EV transition accelerates.

Analyst forecasts are extremely high for this one of the three climate change stocks, projecting nearly a 3x price target to an average of $3.66 per share on ChargePoint’s leadership role in enabling the mass adoption of electric transportation. While the stock price has pulled back recently due to expected short-term moderation in EV demand, investors are looking to capitalize on ChargePoint’s significant growth potential as EVs are projected to become the predominant vehicle type on roads in the coming decades. Moreover, the company nearly reverted last quarter’s gross profit margins, marking it as a one-off occurrence.

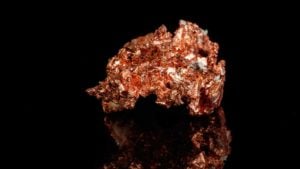

First Quantum Minerals (FQVLF)

Vancouver-based copper mining company First Quantum Minerals (OTCMKTS:FQVLF) is the final choice for investing in climate change stocks. Its share price has soared over 40% in the current year despite reporting a larger-than-expected loss in its recent earnings report. What factors are contributing to this rise? Industry analysts point to increasing consolidation in the copper mining sector, with major companies like BHP Group (NYSE:BHP) setting sight on Anglo American (NYSE:NGLOY) to expand its mining portfolio.

Owners of low-cost operations are highly sought after for their ability to support the growing demand for copper mining. As one of the top global operators boasting three low-cost copper mines, First Quantum could emerge as a potential acquisition target for larger miners seeking to bolster their copper reserves for a low-carbon future. This is especially true as its controversial Cobre Panama contract led to a forced shutdown of the mine while the company reduced its debt by 23% from $7.38 billion to $5.99 billion last quarter.

On the date of publication, Stavros Tousios did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Stavros Tousios, MBA, is the founder and chief analyst at Markets Untold. With expertise in FX, macros, equity analysis, and investment advisory, Stavros delivers investors strategic guidance and valuable insights.