The titan just reported its first-quarter earnings on Wednesday and absolutely smashed investor expectations.

In fact, as Forbes’ Derek Saul noted, “This was Nvidia’s most profitable and highest sales quarter ever, topping the quarter ending this January’s record $12.3 billion net income and $22.1 billion revenue.” And what’s driving all that incredible growth? You guessed it – the firm’s AI division.

These stellar NVDA earnings underscore that demand for AI chips is as strong as ever. And it doesn’t seem like it will retreat anytime soon.

We think that powerful momentum is helping to pave the way for a new era of software growth, one where the gains are just beginning.

Dissecting Record NVDA Earnings

Now, we already mentioned that Nvidia smashed Wall Street’s expectations, but not just on a few line items… The firm beat on every single front. We’re talking revenue, gross margins, operating expenses and incomes; not to mention earnings per share.

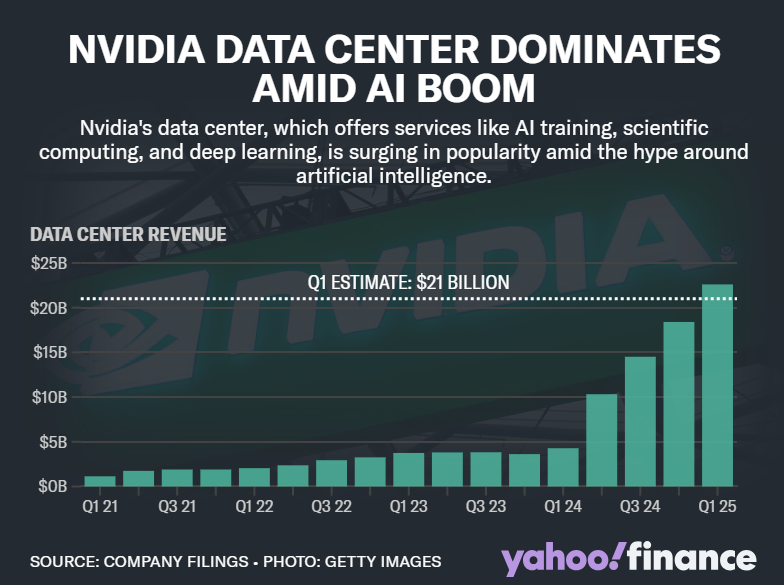

Nvidia achieved record quarterly revenue of $26.04 billion. That’s up 18% from Q4 and a whopping 262% from a year ago. And the lion’s share of Nvidia’s record growth comes from its data center division as the AI Boom shows no signs of slowing down.

The firm’s AI data center division drove a record quarterly revenue of $22.6 billion, up 23% from Q4 and a massive 427% from the year prior. As Nvidia CEO Jensen Huang put it on the earnings call, “the next industrial revolution has begun,” and NVDA is at the center of it.

“Beyond cloud service providers, generative AI has expanded to consumer internet companies, and enterprise, sovereign AI, automotive and healthcare customers, creating multiple multibillion-dollar vertical markets,” said Huang.

And while analysts were expecting adjusted earnings per share (EPS) of $5.65, NVDA blew those estimates out of the water. The AI giant tallied EPS of $6.12, an astounding 461% yearly increase.

As the cherry on top, Nvidia forecast its Q2 earnings to come in around $28 billion, while also announcing a 10-for-1 forward stock split and 150% increase in its quarterly dividend.

These impressive results led the stock to notch fresh all-time highs above $1,000 per share. As I write, NVDA stock is currently up more than 11% on the day.

Now, it’s probably unsurprising that NVDA is soaring right now. After all, since the AI Boom began in late 2022, Nvidia has remained at the industry’s forefront. And now that the stock is pushing $1,060/share, those who missed the NVDA train a few years ago might be kicking themselves.

But make no mistake. Nvidia’s impressive results bode extremely well for more than just itself. The firm’s massive revenue streams confirm that Big Tech is going all-in for top-tier AI chips.

Why?

To power the next-gen software that will run on top of them.

And that means now is the time to prepare for a major AI software boom.

The Final Word

As Nvidia CEO Jensen Huang said in a post-earnings interview, “People want to deploy these data centers right now… They want to put our [graphics processing units] to work right now and start making money and start saving money. And so that demand is just so strong.”

We believe the multi-billion-dollar investment push into AI will create multi-billion-dollar tailwinds for dozens of smaller AI companies over the next few months, just as the macroeconomic backdrop improves in a manner which should support broader stock market strength.

Considering that backdrop, it seems clear that well-positioned AI stocks should soar in the coming months.

And we have a few that you should pay attention to right now.

While NVDA may be untouchable after its recent earnings-driven surge, smaller software stocks are getting ready for liftoff.

The next iteration of this AI boom is coming. So, if you’re hoping to earn hefty profits from this revolution, get invested in the up-and-coming software stocks primed to soar.

Learn all about our favorite software picks.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.