Some say that thanks to geopolitical tensions in the Middle East disrupting oil supply, inflation will reheat back to 4% or 5%. Others believe it will decline toward 2% as the Fed’s rate cuts work to moderate economic demand.

This debate is so important because the answer will ultimately determine where stocks go this summer.

If inflation does flare back up, stocks will likely crash in the summer of 2024. And if it cools down to 2%, stocks could soar.

This outcome is a binary one – and we’re pretty sure we know what’s coming…

Inflation will soon be in the rear-view, and stocks are preparing for a summer blast-off.

Consumers Have Had Enough

Our thesis here is based on lots of market research. But ultimately, we believe the biggest reason inflation is going to crash this summer is shockingly simple: The U.S. consumer is done paying up for stuff.

Ever since COVID’s emergence, U.S. consumers have continued to absorb price hike after price hike on their favorite goods and services. And they’ve done so because they had money to absorb those price hikes.

Throughout 2020 and €˜21, most Americans didn’t do much but were still getting paid, so they stashed that cash in savings. Plus, many received multiple rounds of stimulus checks from the government, borrowed a ton of money at super-low interest rates and saw their investment portfolios soar.

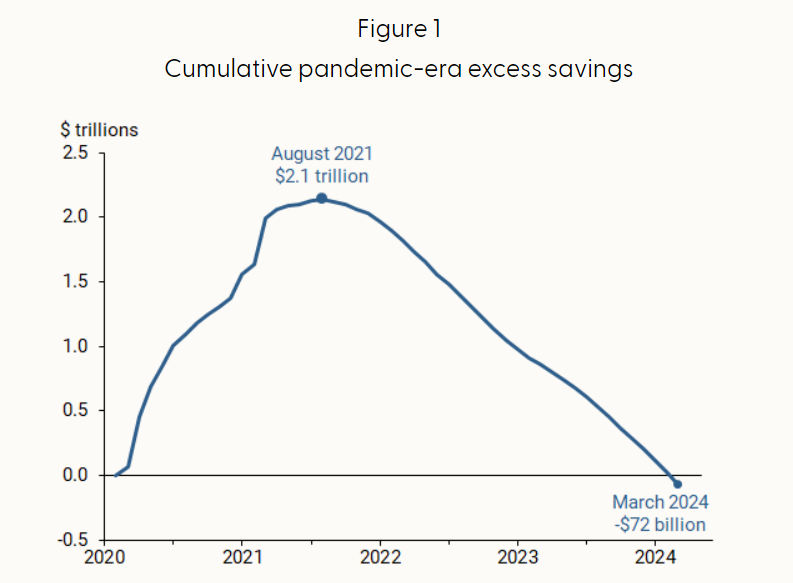

The net result? Americans padded their savings accounts with a ton of excess cash in 2020 and €˜21.

Then, throughout 2022 and €˜23, Americans spent all that excess cash. They went on big vacations, bought nice cars and fancy bags, ate at nice restaurants. They splurged for the past two years.

And when all the companies selling those cars, bags, and meals kept hiking prices, U.S. consumers conceded and said, “fine, we’ll pay up.”

But now that money’s all gone. According to estimates from the San Francisco Fed, Americans depleted the last of their pandemic-era savings in March.

With those excess savings all dried up, Americans are done splurging. They’re now value-seeking.

This is exactly what pretty much every major consumer company has said over the past two weeks.

Value-Seeking Americans Will Help Curb Inflation

We’re in the midst of the first quarter earnings season.

Over the past few weeks, pretty much every company in America has reported quarterly numbers, including many major consumer brands like McDonald’s (MCD), Starbucks (SBUX) and Amazon (AMZN).

And in their earnings conference calls, all said something about consumers becoming very price-sensitive, refusing to pay up, and even starting to trade down on price.

In other words, the U.S. consumer is now value-seeking.

McDonald’s said patrons were being very discriminatory in how they spend their dollars. Amazon said its customers were starting to trade down on price. Starbucks said folks are being really cautious right now.

They weren’t alone.

Denny’s (DENN) said the consumer is becoming increasingly price-sensitive. Big Five (BGFV) said consumers are slowing their discretionary spending. Clorox (CLX) said they are seeing value-seeking across all consumer groups. Mondelez (MDLZ) – the maker of Oreos – echoed the same sentiment; so did Yum (YUM), owner of KFC, Taco Bell, and Pizza Hut.

Across the board, America’s largest consumer brands have been saying the same thing over the past few weeks.

The U.S. consumer is being cautious and price-sensitive. They’re done paying up for stuff. Now they’re looking for discounts and trading down on price.

And of course, that means corporations are done getting away with murder on price hikes.

The Final Word

The slew of quarterly calls over the past few weeks made it clear that firms realize the U.S. consumer is done paying up. And they understand that if they don’t cut prices, they’ll lose business.

The writing is on the wall, folks.

For two years, corporations did nothing but hike prices, and consumers did nothing but pay up. But that is all changing in dramatic fashion right now.

With their savings depleted, consumers have had enough. As a result, companies will slash prices on goods and services going into summer.

We think the net result will be a collapse in the overall inflation rate to 2%.

And that, in turn, will spark an enormous stock market rally.

So, the million-dollar question is: How do you best play this incoming rally?

For that, we turn to the next wave of the AI Boom – robotics.

The AI Boom’s first wave was all about AI software like ChatGPT. And now it seems that wave has come and gone. The next one is approaching, and it’s all about integrating AI software into robots to automate tasks.

This probably sounds like mere science fiction, I know. But everyone from Elon Musk to Jeff Bezos to OpenAI’s Sam Altman is investing in robotics these days.

This is where the smart money is shifting right now. So, if you want to stay ahead of the game, it’s time to shift with them.

Learn all about our favorite AI robotics stocks to buy right now for enormous returns.

P.S. Anyone who has traded in the markets over the past few years knows that volatility is a fact of life. While there is no way to avoid volatility, there are ways to trade it. In fact, volatility can be a trader’s best friend, and my colleague Jonathan Rose has been trading volatile markets for over 25 years.

Jonathan is a master trader. He was a bona fide market maker for many years, a floor trader at the Chicago Mercantile Exchange, and the Director of Trading at a multimillion-dollar proprietary trading firm. He has also trained over 100 traders who went on to become professionals in the field.

Today, Jonathan shared the details behind one of the most consistent and lucrative trading strategies he discovered during his tenure as a professional trader. In fact, over the past three years, 90.3% of the trades Jonathan recommended using this strategy have been profitable.

But Jonathan is not just skilled in trading; he is also a gifted teacher with a talent for simplifying complex trading concepts. And in his special Masters in Trading Summit, Jonathan shares all about the strategy he and other CBOE Exchange traders use.

If you missed the summit, don’t worry! Sign up to catch the replay tonight, May 8, at 8 p.m. EST as Jonathan pulls back the curtain on his massively profitable trading strategy.