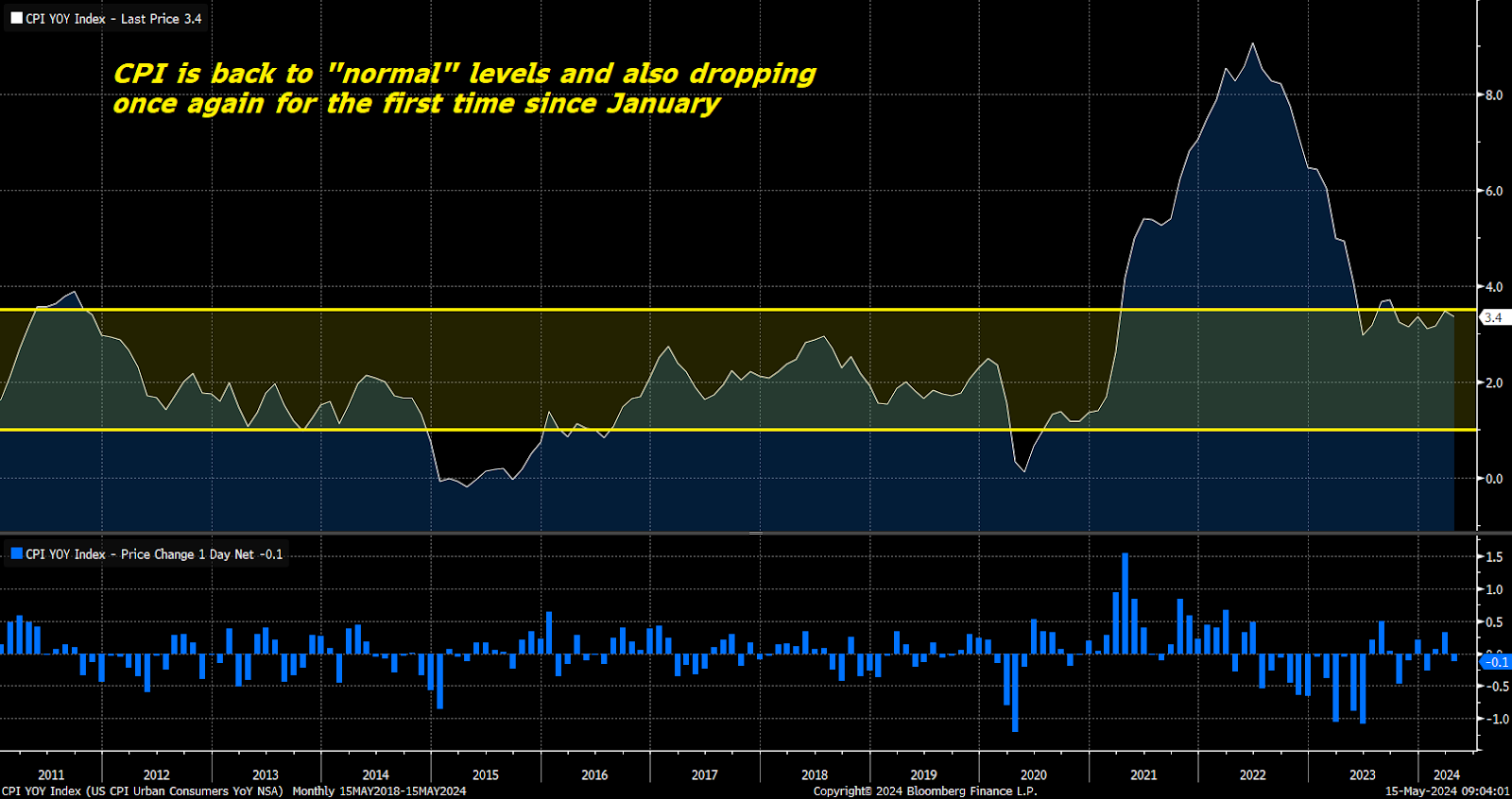

Indeed, this morning’s hugely important Consumer Price Index (CPI) report came in softer than expected, illustrating that inflation is resuming its decline to 2%. And that primes a specific subset of stocks to absolutely soar into the summer.

Specifically, April’s CPI report reflected that consumer prices rose just 0.3% month-over-month, less than the 0.4% rise expected by economists. Core consumer prices – or consumer prices excluding food and energy – rose just 0.3%, too.

More importantly, the year-over-year consumer price inflation rate dropped from 3.5% in March to 3.4% in April, ending a two-month streak of rising inflation rates. The same is true for core inflation rates, which slid from 3.8% to 3.6% in April after flatlining in May.

In other words, inflation is dropping again for the first time since January. And we believe it’s likely to keep dropping for the foreseeable future, too.

The Inflation Low-Down

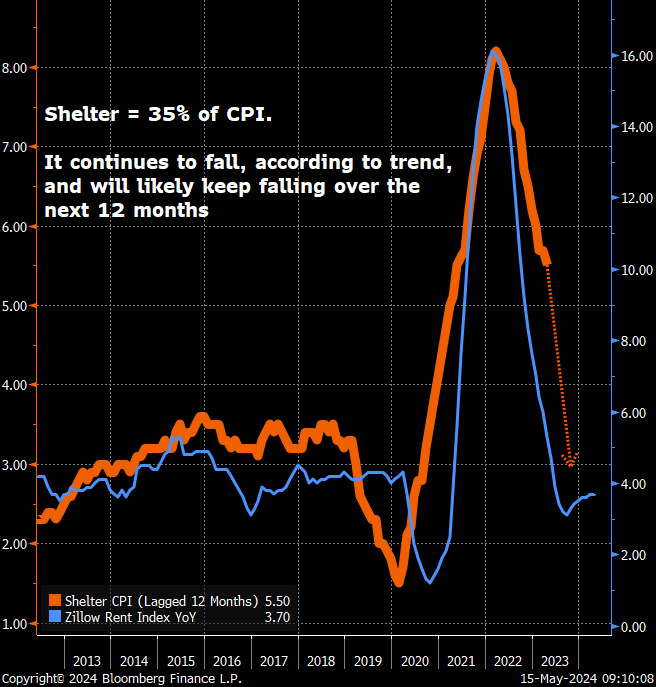

One of the best kept “secrets” about CPI is that, excluding housing, inflation is basically already running at the Federal Reserve’s 2% target. That is, excluding housing costs, consumer prices rose just 2.2% in April.

The ex-housing inflation rate has now been running roughly at or below 2% for almost a year.

That means the only real remaining “sticky” part of inflation – the only thing really keeping it elevated – is shelter CPI. But shelter CPI is starting to roll over.

Over the past year, it has steadily dropped from about 8.2% to just 5.5% in April. And this trend of falling shelter CPI is set to continue.

Historical analysis shows that shelter CPI tends to lag real-time rent trends – as gauged by Zillow’s Rent Index – by about 12 months. And Zillow’s index has been falling for two years now. That, of course, means shelter CPI should keep falling for the next 12 months.

As shelter CPI continues to drop over the next several months, inflation will grind its way back toward 2%.

And that is hugely bullish for stocks.

The Final Word

For the past several months, the U.S. Federal Reserve has consistently expressed its willingness to cut interest rates once it feels confident that inflation is on a sustainable trajectory back to 2%.

And we believe that as inflation resumes its descent to 2% over the coming months, the Fed will find that confidence. It’ll start to talk more about rate cuts. And the market will start to price in more rate cuts for the rest of the year.

As that happens, stocks will soar – especially certain small stocks.

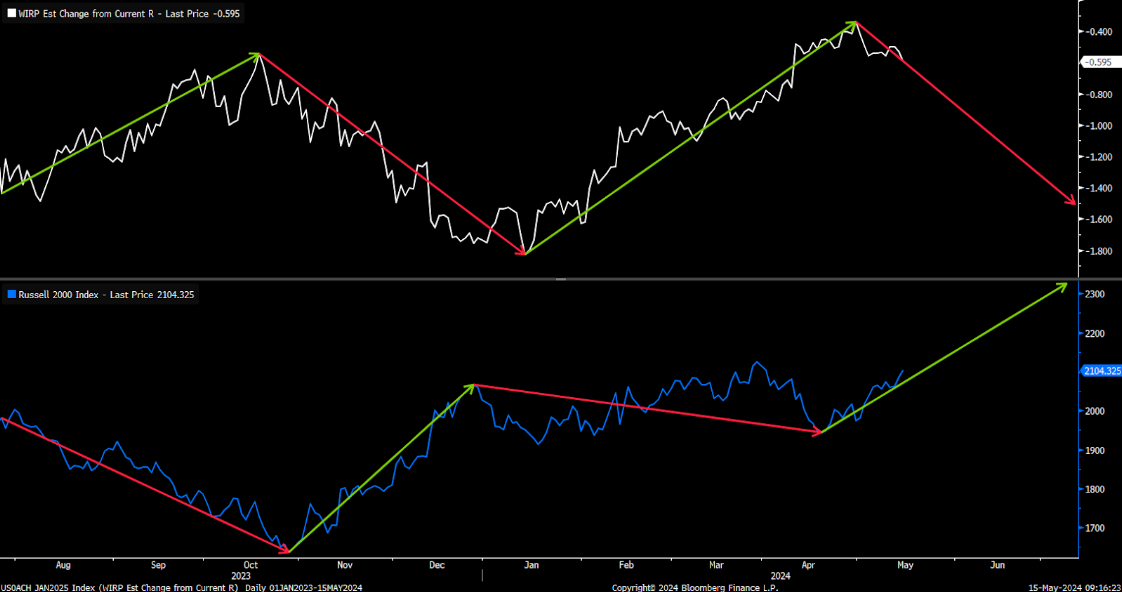

Just look at the strong relationship that has developed between small stocks and the market’s rate-cut pricing.

From July 2023 to October 2023, the market dramatically reduced its rate-cut bets. And small stocks crashed.

Then, from October 2023 to December 2023, the market dramatically increased its rate-cut bets, and small stocks absolutely soared. But between January 2024 and April 2024, the market again reduced its rate-cut bets, and small stocks struggled.

Now rate-cut bets are ramping back up again. And that should continue as inflation softens over the next few months.

As rate-cuts bets rise, small stocks will soar.

So, if you’re hoping to potentially make a lot of money between now and this summer, we firmly believe small stocks will offer the best opportunity to do just that.

Several of them could even double by the summer – but only the right stocks will skyrocket.

Find out which small stocks we think are the right ones to buy today.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.