So far, the results have been excellent.

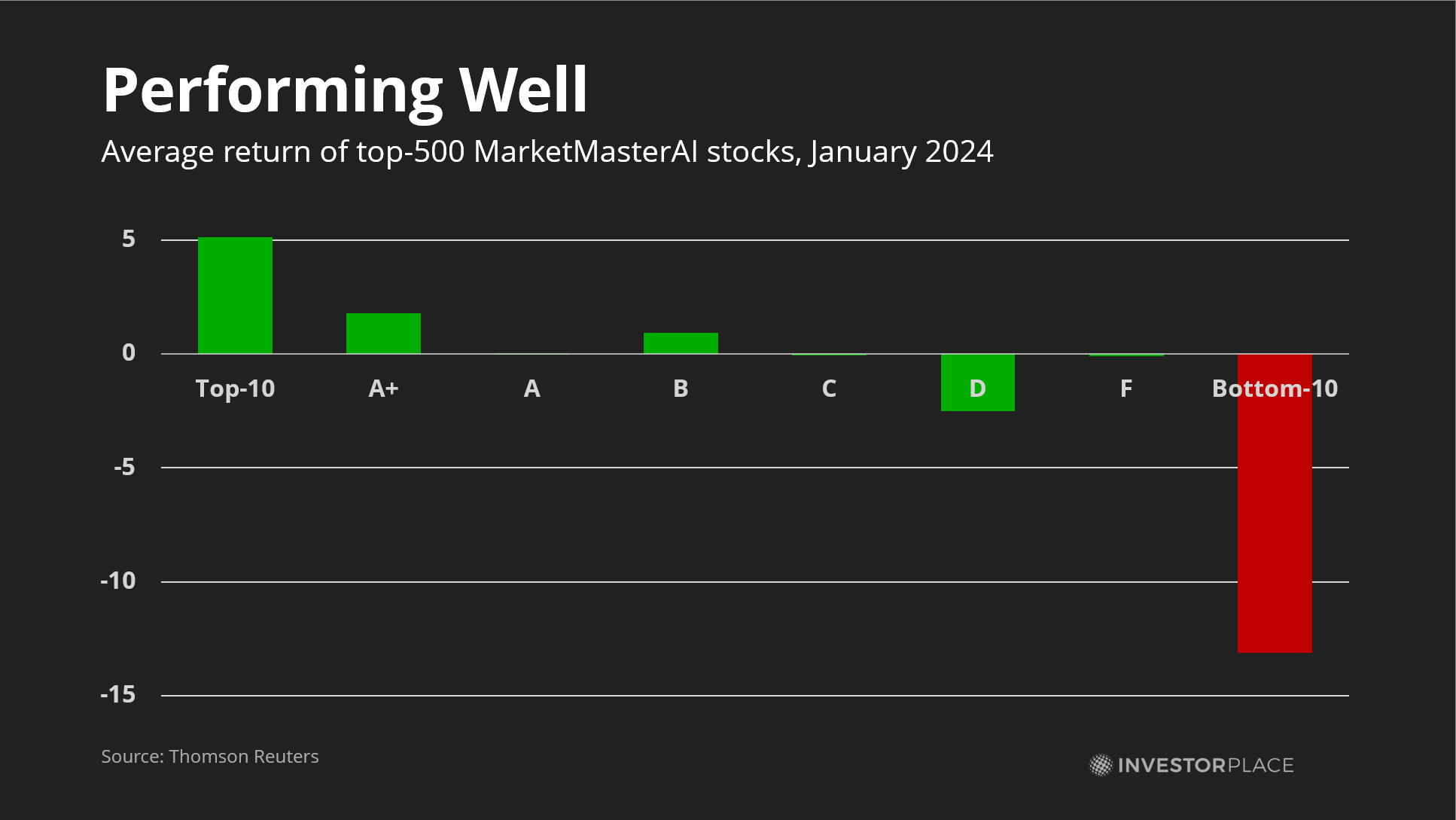

Since January, the average 1.8% rise in A+ stocks has almost quadrupled the average 0.46% return. Returns among the top 10 picks exceeded 5%.

The system has also been exceptional at picking stocks to avoid. Since MarketMasterAI made its predictions, the 10 worst F-rated stocks have dropped an average of 13%.

Of course, the system occasionally misses moonshot stocks. Shares of F-rated Super Micro Computer (NASDAQ:SMCI), a firm favored by Louis Navellier (subscription required), have more than doubled so far this year. But MarketMasterAI seeks to do better on average, downgrading firms like SMCI in favor of more consistent picks. In fact, nine out of 10 top MarketMasterAI picks have gone up this year, compared to just 52% of the top 500 stocks!

The best part is that MarketMasterAI keeps adjusting as new data becomes available. More than half of S&P 500 companies have now reported fourth-quarter earnings, and the unusual number of earnings beats is pushing the system into riskier growth stocks.

Pivoting into Growth

On average, the latest group of top stocks are faster-growing than before. Analysts expect these top picks to grow revenues by 8.3% this year (compared to the market average of 5.7%) and earnings by 14.6% (vs. the market average of 6.9%). That’s a significant acceleration from December’s picks, which saw revenue and EPS growth of 6.9% and 9.6%, respectively.

However, three major changes stand out.

Firstly, energy stocks are now replaced by insurance firms. Oilfield service companies Halliburton (NYSE:HAL) and Hess (NYSE:HES) drop out of the top 25 on downward revisions to global oil output estimates. High-quality Schlumberger (NYSE:SLB) barely hangs on at number 23.

Second, many healthcare stocks also leave the top 25 this month after enormous January run-ups. Formerly top-ranked Eli Lilly (NYSE:LLY) has returned 12% since January on optimism over its weight-loss and diabetes drugs. Its expected upside consequently drops to 6.5%, earning the firm an average C grade. Firms like Regeneron Pharmaceuticals (NASDAQ:REGN) and Amgen (NASDAQ:AMGN) have seen similar moves, and thus drop out of the top rankings.

Finally, several large industrial and consumer-facing firms move up the ranks to replace healthcare picks. These companies tend to rise steadily during mid-stage economic recoveries as demand improves.

Together, that means the average beta of the top-25 portfolio actually drops from 0.81 to 0.77, a remarkable reduction in volatility given a pivot into growth stocks.

The Top 25 Stocks to Buy Immediately, According to AI

These findings are summarized in the table below. Of particular note is No. 1 ranked Marsh & McLennan Companies (NYSE:MMC) and No. 2 Arthur J. Gallagher (NYSE:AJG). Both of these firms rose 33% or more in 2021, a period of strong economic recovery, and analysts expect 2024 to bring similar conditions.

The inclusions of single-family REITs Equity LifeStyle Properties (NYSE:ELS) and American Homes 4 Rent (NYSE:AMH) are also notable. These firms typically only perform well during economic expansions, and so their presence is a highly bullish sign of the economy.

Finally, no Magnificent Seven stock makes this month’s list again. Shares of these high-growth tech stocks have moved so high so quickly that MarketMaster AI believes further growth is unlikely.

| Rank | Ticker | Company Name | Expected 6-Month Return | Grade | Business |

| 1 | MMC | Marsh & McLennan Companies Inc | 11.8% | A+ | Insurance Brokers |

| 2 | AJG | Arthur J. Gallagher & Co. | 11.7% | A+ | Insurance Brokers |

| 3 | RBA | RB Global Inc | 11.6% | A+ | Diversified Support Services |

| 4 | MNST | Monster Beverage Corp | 11.5% | A+ | Soft Drinks & Non-alcoholic Beverages |

| 5 | FDS | Factset Research Systems Inc | 11.4% | A+ | Financial Exchanges & Data |

| 6 | EA | Electronic Arts Inc | 11.4% | A+ | Interactive Home Entertainment |

| 7 | ELS | Equity LifeStyle Properties Inc | 11.4% | A+ | Single-Family Residential REITs |

| 8 | RYAN | Ryan Specialty Holdings Inc | 11.3% | A+ | Insurance Brokers |

| 9 | ODFL | Old Dominion Freight Line Inc | 11.3% | A+ | Cargo Ground Transportation |

| 10 | PG | Procter & Gamble Co | 11.2% | A+ | Household Products |

| 11 | CASY | Caseys General Stores Inc | 11.1% | A+ | Food Retail |

| 12 | MA | Mastercard Inc | 11.0% | A+ | Transaction & Payment Processing Services |

| 13 | HEI-A | HEICO Corp | 11.0% | A+ | Aerospace & Defense |

| 14 | CSGP | CoStar Group Inc | 10.8% | A+ | Research & Consulting Services |

| 15 | NOC | Northrop Grumman Corp | 10.8% | A+ | Aerospace & Defense |

| 16 | ROL | Rollins Inc | 10.8% | A+ | Environmental & Facilities Services |

| 17 | AMH | American Homes 4 Rent | 10.8% | A+ | Single-Family Residential REITs |

| 18 | BSY | Bentley Systems Inc | 10.8% | A+ | Application Software |

| 19 | KO | Coca-Cola Co | 10.7% | A+ | Soft Drinks & Non-alcoholic Beverages |

| 20 | VRSK | Verisk Analytics Inc | 10.6% | A+ | Research & Consulting Services |

| 21 | V | Visa Inc | 10.6% | A+ | Transaction & Payment Processing Services |

| 22 | BF-B | Brown-Forman Corp | 10.6% | A+ | Distillers & Vintners |

| 23 | SLB | Schlumberger NV | 10.5% | A+ | Oil & Gas Equipment & Services |

| 24 | MOH | Molina Healthcare Inc | 10.5% | A+ | Managed Health Care |

| 25 | APD | Air Products and Chemicals Inc | 10.5% | A+ | Industrial Gases |

10 Stocks to Sell

MarketMasterAI also updates its lowest-ranked companies. This month, many surging stocks land on the bottom 10. AppLovin (NASDAQ:APP) has seen shares rise 220% over the past year, while Super Micro is up over 600% once you include January’s rise. History tells us that these firms tend to pull back after a major run-up, and so the AI system warns investors to take profits.

Meanwhile, healthcare firms Illumina (NASDAQ:ILMN) and Sarepta Therapeutics (NASDAQ:SRPT) have struggled to gain much traction, causing MarketMasterAI to grade them as sells. If history is right, these 10 stocks are ones investors should tactically avoid for the next six months.

| Rank | Ticker | Company Name | Expected 6-Month Return | Business |

| 491 | PANW | Palo Alto Networks Inc | 2.8% | Systems Software |

| 492 | GTLB | GitLab Inc | 2.6% | Systems Software |

| 493 | KRTX | Karuna Therapeutics Inc | 2.6% | Biotechnology |

| 494 | PCOR | Procore Technologies Inc | 2.6% | Application Software |

| 495 | MRVL | Marvell Technology Inc | 2.4% | Semiconductors |

| 496 | ILMN | Illumina Inc | 1.9% | Life Sciences Tools & Services |

| 497 | DKNG | DraftKings Inc | 1.3% | Casinos & Gaming |

| 498 | APP | AppLovin Corp | 0.8% | Application Software |

| 499 | SRPT | Sarepta Therapeutics Inc | 0.4% | Biotechnology |

| 500 | SMCI | Super Micro Computer Inc | -0.6% | Technology Hardware, Storage & Peripherals |

On the date of publication, Thomas Yeung held no positions in any stock mentioned in this piece. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Tom Yeung is a market analyst and portfolio manager of the Omnia Portfolio, the highest-tier subscription at InvestorPlace. He is the former editor of Tom Yeung’s Profit & Protection, a free e-letter about investing to profit in good times and protecting gains during the bad.