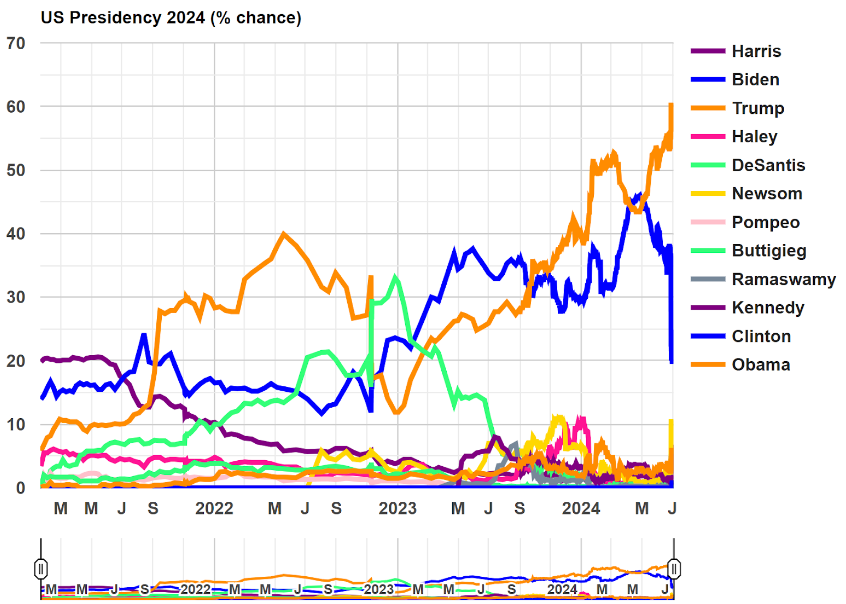

Ahead of the recent debate, betting markets showed that President Joe Biden and Donald Trump were neck-and-neck in the White House race. Since then, however, Trump has pulled way ahead, with his composite odds of winning in November standing around 60% today.

Biden, meanwhile, has fallen to 20% odds. Other potential candidates (like Governor Gavin Newsom, Vice President Kamala Harris and others) are all around 20% odds, too.

In other words, for the first time in this race, the betting markets are saying Trump has a very good chance of winning the November election.

If that comes to be, certain stocks are likely to perform extremely well.

Uncovering the Trump Trade

Donald Trump has a unique set of pro-business economic policies, which include tax cuts for corporations, deregulation efforts to reduce government oversight and incentives for domestic manufacturing. Such policies are hoped to stimulate economic growth. In theory, they could lead to increased corporate profits, stronger business investment and, potentially, accelerated job creation. This approach also means that certain market sectors would thrive under such conditions.

Now, we can hypothesize what those policies will do to the economy and market over the next four years if Trump wins in November.

Or, we could reflect on what happened the first time Trump was president in the late 2010s.

During his first term, economic growth strengthened, and corporate profits soared on the back of loosening regulations and tax cuts. At the same time, though, the inflation rate rose significantly in the first two years of Trump’s presidency, and Treasury yields rocketed higher.

What did those things mean for the stock market?

Generally, stocks did very well in the first two years of Trump’s presidency. The S&P 500 rose about 40% from the day he was elected to a peak in October 2018.

But small-cap stocks did even better as they benefited from tax cuts, protectionist policies and America-first manufacturing decrees. The small-cap Russell 2000 rallied about 50% from trough to peak in the first two years of Trump’s first presidency.

Tech stocks also did very well in 2017 and €˜18. From November 2016 to September 2018, the Nasdaq Composite rallied 60%.

And within the tech sector, hypergrowth small-cap tech stocks did the best. The ARK Innovation ETF (ARKK) – a collection of hypergrowth tech stocks – soared nearly 160% from Election Day 2016 to late summer 2018.

The Final Word

In other words, during roughly the first two years of Trump’s presidency:

- Stocks rallied 40%.

- Small-cap stocks rallied even more (+50%).

- Tech stocks rallied even more (+60%).

- Hypergrowth tech stocks rallied the most (+160%).

According to historical precedent, then, when it comes to the €˜Trump Trade,’ buy small hypergrowth tech stocks.

Of course, there are more variables at play here beyond Donald Trump winning the presidency. However, in this situation, we do think that history can provide us with a fairly accurate guide for the future.

If so, then it may be time to bet on a hypergrowth stock surge over the next few years.

A lot is sure to change between now and Election Day. But the betting markets are shifting. If they continue to, the stock market will likely begin embracing the €˜Trump Trade.’

And if that happens, hypergrowth tech stocks may well surge.

To prepare, check out a few of our favorite hypergrowth stocks to buy right now.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

P.S. You can stay up to speed with Luke’s latest market analysis by reading our Daily Notes! Check out the latest issue on your Innovation Investor or Early Stage Investor subscriber site.